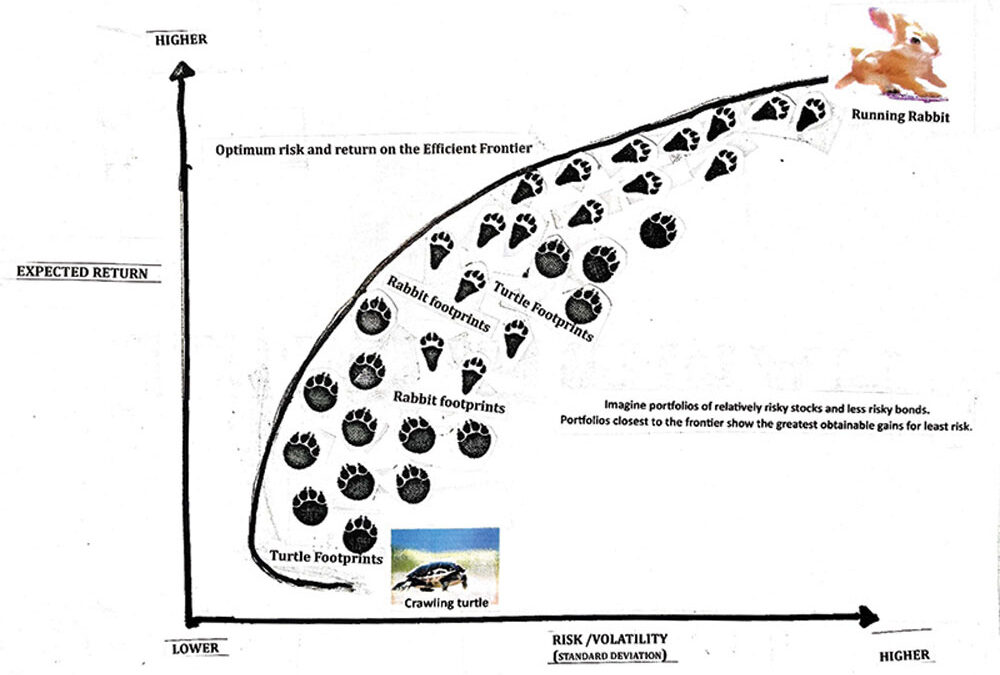

RETURNS AND RISKS A drawing of the Modern Portfolio Theory, an investment theory created by Nobel Laureate Harry Markowitz in 1952.

If stocks perform like hopping rabbits, who needs sluggish bonds in the Santa Cruz Mountains? The answer lies not in market timing but numerous CFP queries, which confirm clients are not always comfortable with an all-stock portfolio that could lose 30% of its value in a year—as sleeping rabbit stocks did in 2008.

Past performance is not a guarantee or a reliable indicator of future results. Stocks and bonds are more liquid and less troublesome than real estate, and bond prices vary more with interest than stock fluctuations. Over the past 50 years, Forbes reports that “stocks averaged 11.1% annual returns while Baa Corporate Bonds delivered 8.49% on average, and cash yielded 4.3%.”

But mixing steady turtle bonds with stocks per Modern Portfolio Theory allows investors to maintain higher overall expected rates of return than they could with CDs while flattening the portfolio roller coaster.

Bonds are IOUs from companies or governments, domestic or foreign, to repay borrowed debt with interest. Corporate bonds finance debt with risk premiums that make corporate debt more lucrative as investments. “In the long run,” writes Smartasset.com, “if you were to only invest in AAA corporate bonds over time, you can expect a modern yield between 4% and 5%.”

When companies fail, bonds are safer than stocks because bondholders get paid before stockholders. Default risk is lesser and liquidity higher with short-term investments, so long-term bonds pay better usually.

Distressed companies issue junk bonds (rated below BBB) that pay higher yields for risk of default—a risk advantageously different from market risk. TRoweprice.com shows average High Yield Bonds indexed at 6.8% over the past 10 years, “the combination of enhanced yield and the potential for capital appreciation (though less than for equities) means that high yield bonds can offer equity-like total returns over the long term.” Prices may rise if a “fallen angel’s” credit ratings improve.

Government securities can be CA state or local municipal bonds not taxed by the IRS or CA, out of state bonds taxed by CA only, or Federal bonds, notes or bills exempt from CA taxes. Series I savings bonds have returns adjusted for inflation. Municipalities have gone broke but federal bonds are backed by 200 years of solvency. Wealthy investors buy municipal bonds because their “tax equivalent yield” equalizes government and private returns.

Mortgage bonds (e.g. Fannie Mae) let investors purchase housing debt with some government assurances. Smartasset.com says Treasuries paid yields over 20 years of 3-4% while Munis paid pre-tax “a 2.12% average annual return, although that figure has fluctuated from a 9.6% high to a -2.6% loss.”

All these bonds can generate capital gains or losses if they aren’t new bonds held to maturity and all bear interest rate risk. When interest rates increase, the opportunity cost of holding low interest rate bonds increases, so those bonds’ prices decrease. With varying “duration,” Bond values plummet if interest rates go up but increase if interest rates drop. You can ladder bonds with different maturities to reduce risk of capital losses with yearly purchases and sales (or hedge with derivatives). Long-term bond investments bear more interest and default risk, so naturally they pay higher yields.

Nobel Laureate Harry Markowitz argued that a portfolio’s total returns and risk (standard deviation) mean more than the risk of any investment, and that diversification of assets can adjust portfolios to individual risk preferences. If a two-asset portfolio has some stocks and some bonds in it, you can calculate the portfolio’s expected returns and expected risks.

On the attached chart, portfolios on the efficient frontier curve represent optimized balances of expected returns and risks. Portfolios above the frontier are not possible and portfolios below the curve could be improved with the purchase of more stocks for performance or more bonds to reduce risk. Risk is difficult mathematically to plot without a financial advisor’s computer and multi-asset balancing is increasingly complicated.

Modern Portfolio Theory justifies diversification with any kind of profit-making behavior, which does not correlate to the stock market: bonds, stock options, commodities, art, Krypto-currency or real estate. Diversify portfolio holdings smoother turtle bond rides to financial freedom. In some years, tortoises beat hares!

Robert Arne, EA, CFP, MS, of Carpe Diem Financial Life Planning, gives holistic financial advice as his client’s fee-only fiduciary. He serves mostly Santa Cruz Mountain dwellers. These articles must not be read as personal financial, mortgage, tax or investment advice; consult appropriate professionals.