Survivor Planning for Disability and Death

JUNE 24, 2020

“I must not fear. Fear is the mind-killer. Fear is the little-death that brings total obliteration. I will face my fear. I will permit it to pass over me and through me. And when it has gone past I will turn the inner eye to see its path. Where the fear has gone there will be nothing. Only I will remain.” — Frank Herbert, Dune

Life Update

Sometimes the planner himself becomes beneficiary of planning: health insurance saved me from financial ruin after I fell from a railway trestle. I quickly learned to rethink Estate planning when all seemed lost and then was grateful for savings to pay for home remodeling, a new van and a limited amount of long term care. This changed auto and home insurance and long term investment philosophy. It also gave me new reason to stand again as a planner who can help others with newfound life.

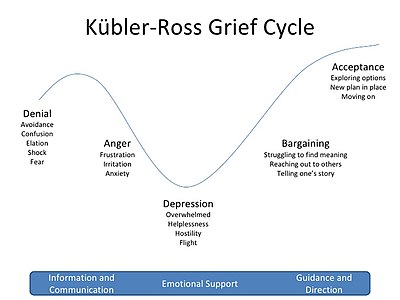

Estate planning is the topic of a later section; here I am concerned with the survivor. In our forties, my soulmate departed with cancer. Soon thereafter, parents passed. Staring at a snowy mountain, I swore to honor memories by making something of the rest of my life; slowly but surely with meditation practice, shocking numbness and tearful angst passed and vitality overwhelmed helplessness. Death jolts survivors whose finances may be a challenge: change may go on hold as you wisely avoid recklessly emotional decisions.

Survivor planning relates to the new search for meaning in Kubler-Ross’s “bargaining” phase. Survivors may rue the day or seize the day. All must be reconsidered: education, retirement, investments, insurance and your new estate. When meaning or purpose emerge again, there is reason to make a new financial life plan.