Investment Philosophy

Staying the course of wisdomLet us invest on principle.

With seemingly random markets, clients can take two wise courses:

Meet the Market Strategies

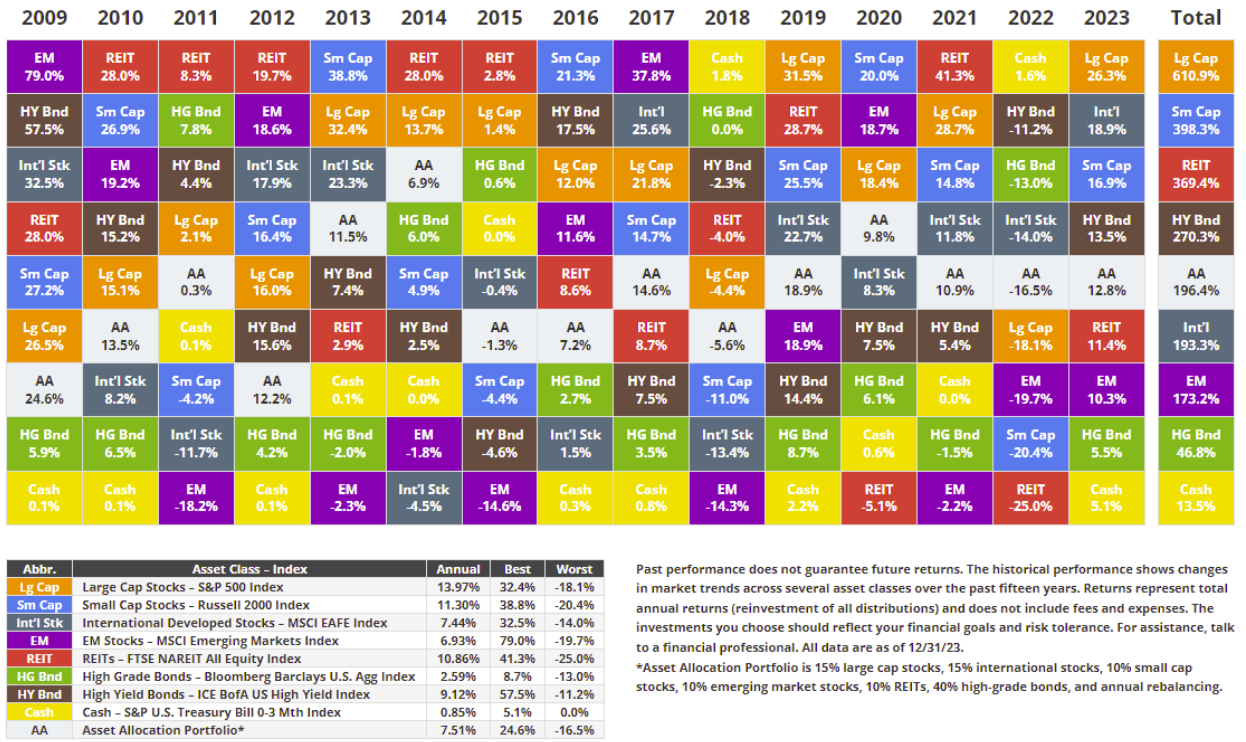

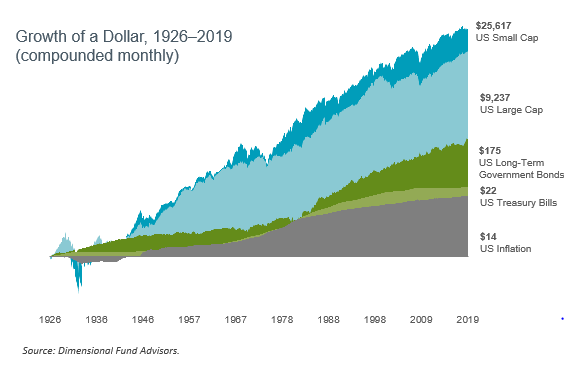

As an Anglo-American historian of the post-industrial era and a business cycle student at the University of Chicago, I’ve learned the broadest perspectives upon long term market history. While the short run picture is crashing waves of unpredictable force flowing up and down the beach, the long term tidal growth trajectory is based on human resiliency in a spontaneous market order, increasingly superior technical and scientific mastery of nature, and increasing amounts of capital to allow for more efficient but more roundabout methods of production. Humanity has recovered from world wars, a 1919 flu far worse than the coronavirus, great depressions and great recessions, oil embargoes and environmental degradation. Providing service at all times, rebalancing portfolios and lending confidence to investors in challenging times give greatest value here. Past performance doesn’t guarantee future results, but the chart below does show the stock and bond investor’s long-term historical experience. Index fund purchases of Exchange traded funds (ETFs) or no load mutual funds may approximate the bumpy historical performance below.

Beat the Market Strategies

For those daring enough to seek improvements on S & P 500 performance, follow me. I do favor value investing (with heroes like Benjamin Graham, John Templeton, and Warren Buffett) because bargain-hunting stock pickers are likely to find discounted companies with high returns on invested capital that slightly outperform the glitter of growth over time, and certain premiums can be gained for small cap investing or investments abroad where the earnings per share is higher than in America. Investors who want to hedge boldly may consider relatively conservative options strategies based on Austrian Economics: we may gamble against government-induced inflationary policies and the resulting herd behavior leading to booms and busts. This strategy appears vindicated by superior market performance.

This chart was the basis of our logo: it ties the gentle San Lorenzo Valley to stock and bond market growth since 1926.

“Life is either a daring adventure or nothing at all.” – Helen Keller